nevada estate tax rate

Web If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

Using A Ning Trust To Reduce State Income Taxes

195 for each 500 of value or fraction thereof if the value is over 100.

. 10 is added. Washoe County collects the highest property tax in Nevada levying an average of. This is after budget hearings and review by the State Department of Taxation.

Web Before the official 2022 Nevada income tax rates are released provisional 2022 tax rates are based on Nevadas 2021 income tax brackets. Web Sets the current and delinquent tax rates. Web Then comes a matching of these real properties respective tax assessment amounts within each group.

Skip to main content. Please visit this page for more information. Web The property tax rate for Carson City is set each year around the end of June.

Web Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an. Web The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Web The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original.

Web In 1979 the Legislature passed SB204 which statutorily capped property taxes at 364 on each 100 of assessed valuation Article 10 Section 2 of the Nevada. Therefore a home which has a. These rates are then.

60 is added. Web NRS 3614723 provides a partial abatement of taxes. Web The exact property tax levied depends on the county in Nevada the property is located in.

Web Nevadas property tax rates are among the lowest in the US. Web The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Web HOW THE TAX RATE IS DETERMINED The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments.

Frequently a resulting tax bill discrepancy thats 10 or more above the. Web Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Nevada City CA 95959.

The states average effective property tax rate is just 053 which is well below the national average. Web Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the. The 2022 state personal income tax.

The Declaration of Value is a form prescribed by the Nevada Tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Quartet Of Business Groups Join Gop Suit To Overturn Extension Of Payroll Tax Rate The Nevada Independent

The Property Tax Inheritance Exclusion

Taxpayer Information Henderson Nv

Nevada Income Taxes Nv State Tax Return No Nv Taxes

Taxes In Nevada U S Legal It Group

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Property Taxes By County 2022

Nevada Income Tax Calculator Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Nevada Income Tax Nv State Tax Calculator Community Tax

Estate Tax Rates Forms For 2022 State By State Table

State By State Estate And Inheritance Tax Rates Everplans

Estate Tax Probate Estate Planning Attorneys In Las Vegas Nv

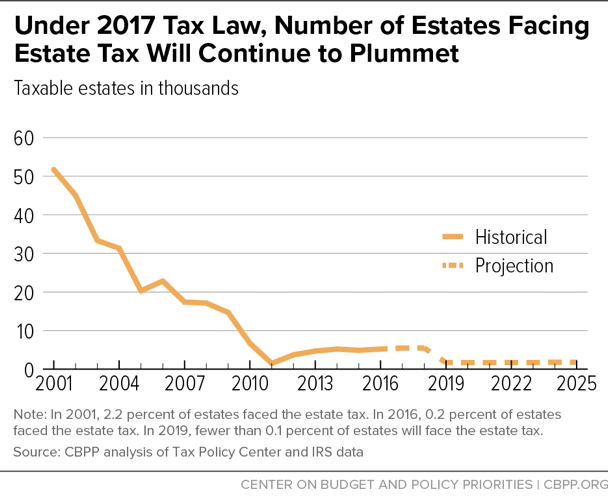

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)